Introduction Mindful Trader

In the fast-paced world of financial markets, where decisions are made in split seconds and outcomes can be unpredictable, the concept of mindful trading emerges as a beacon of stability and clarity. Mindful trading isn’t just about executing trades; it’s a holistic approach that integrates the principles of mindfulness into every aspect of the trading process.

At its core, mindful trading encourages traders to cultivate awareness of their thoughts, emotions, and behaviors while navigating the complexities of the market. It emphasizes the importance of being present in the moment, making informed decisions, and managing risk effectively.

In this blog post, we delve deep into the realm of mindful trading, exploring its significance, techniques, tools, and strategies. Whether you’re a seasoned trader looking to refine your approach or a novice seeking to enhance your trading skills, embracing mindfulness can potentially transform your trading experience.

Join us on this journey as we uncover the power of mindfulness in trading and discover how you can harness it to become a more confident, disciplined, and successful trader.

This introduction sets the stage by defining mindful trading, highlighting its relevance in the financial markets, and inviting readers to explore its benefits and applications further in the upcoming sections of your blog post.

What is Mindful Trader?

“Mindful Trader” refers to the practice of applying mindfulness techniques and principles to the act of trading in financial markets. Mindfulness, rooted in ancient contemplative practices like meditation, involves cultivating awareness and non-judgmental attention to the present moment. When applied to trading, mindfulness helps traders become more conscious of their thoughts, emotions, and behaviors, thereby enhancing their decision-making processes and overall trading performance.

Here are some key aspects of what it means to be a mindful trader:

- Awareness: Mindful traders are attuned to the present moment, noticing market fluctuations, their own reactions, and external influences without being overwhelmed or reactive.

- Emotional Regulation: They learn to manage emotions like fear and greed, which can cloud judgment and lead to impulsive trading decisions. Mindful traders cultivate a balanced emotional state conducive to making rational choices.

- Focus and Concentration: Mindfulness practices improve concentration and focus, enabling traders to maintain attention on their trading strategies and goals amidst distractions.

- Risk Management: Mindful trading emphasizes a disciplined approach to risk management. Traders assess risks objectively and make decisions based on careful analysis rather than impulse.

- Adaptability: Mindful traders are adaptable and resilient in the face of market volatility or unexpected events. They can pivot strategies when necessary without succumbing to panic or anxiety.

- Long-Term Perspective: Mindful trading encourages a long-term perspective, prioritizing sustainable growth and consistency over short-term gains or losses.

- Learning and Growth: Mindful traders continuously seek to improve their skills and learn from both successes and failures. They view setbacks as opportunities for growth rather than personal failures.

Overall, being a mindful trader involves integrating mindfulness into one’s trading routine to foster a balanced and mindful approach to decision-making, risk management, and emotional well-being in the dynamic world of financial markets. By cultivating mindfulness, traders can potentially enhance their overall trading experience and achieve greater success over time.

Benefits of Mindful Trading

Key features of the Mindful Trader service

The platform is quite different from its analogs in terms of its capabilities. The main difference is that the service does more than simply provide alerts on trading options and stocks. The trader receives a detailed analysis of the market situation from Ferguson. The easiest way to see this is through the example of live trades. The section includes all trades ever conducted by Ferguson, including current ones. Here are the entry and exit points, stop-loss price, maximum hold time, position size, and other data.

The maximum holding time has a special place. Thanks to this parameter, instead of waiting until the price target is reached or the stop loss is triggered, Ferguson immediately sets an additional time limit of several days for the trade. This is necessary to minimize the risk since only three things can happen to it during the period of the trade: (i) the trade reaches the target value and closes; (ii) the trade reaches a stop loss and closes; or (iii) the trade does not reach either the target value or the stop loss and closes after the specified time.

As a result, Mindful Trader ensures that the risk is low and very short-lived and that losses are minimized. This approach demonstrates Eric Ferguson’s global strategy, which is called “momentum trading”. If the expected momentum does not unfold within a couple of days (conditionally), the trade is closed. However, this is just one of the features provided by Mindful Trader, a trading option and stock alert system. Below the Traders Union will take a detailed look at all the functions, options, and services of this alert system.

Trading alerts for stocks

This function is the primary reason swing traders subscribe to Mindful Trader. Alerts (also called notifications) sent by Eric Ferguson to subscribers include brief information about each stock traded and under what conditions he bought it. A trader can copy Ferguson’s trade completely or use it for their own analytics. Example of a typical alert: “I bought AMGN for 245.63. Set a profit target of 255.21. Set a stop loss of 236.05. Closing on 24.10.22”.

The first word in the notification about trading options or stocks briefly tells you which position to open – long (buy) or short (sell). Mindful Trader sends sales alerts more frequently, while purchase alerts do not differ in structure. In this example, the trader received a purchase alert. The stock ticker of the company whose stock Ferguson is purchasing comes next in line. In this case, it is AMGN, the ticker of Amgen Inc., the largest biotech company in the United States.

The following is the purchase price (same as the trade entry price). Note the value of AMGN stock. Ferguson does not indicate here how many stocks he buys (this can be viewed in an individual block with all his trades). Concerning potential risk, a trader purchases as many stocks at the specified price as their own budget and money management rules allow. For example, you need to remember that the amount of each trade should not exceed 1-1.5% of your trading capital.

The currency used in Mindful Trader alerts is US dollars only. Therefore, if the notification contains “245.63”, it means that Ferguson is buying AMZN stocks at $245.63. It is important to remember that the stock price may change by the time a trader enters a trade, but if he reacts quickly (quick use of the received signals is the essence of alerts), the changes will be insignificant. The same is true for the profit price, which in this case is 255.21. This means that as soon as the value of one stock reaches $255.21, the trade will be closed.

In alerts on trading options and stocks, Mindful Trader always indicates the stop-loss price, that is, the price after which the probability of making a profit is excluded. In the above example, this is $236.05. As soon as the stock price drops to the specified level, the trade will be automatically closed. In this case, the trader will suffer losses (like Ferguson himself), but they will be minimal under this market situation.

Finally, the “closing” menu item represents the maximum holding time, which was discussed above. It allows you to minimize potential losses. The idea is that the price may not fall to the stop-loss level, but at the same time, it may not rise to the target value of the asset. This condition can persist for many days, and every day a trader will take risks due to an unpredictable asset position or even lose money. To prevent this from happening, Mindful Trader’s alerts include a specific date, in the above example, 24.10.2023. At the beginning of the specified trading day, the trade must be closed if the target or stop loss is not reached.

Mindful Trading Strategies

Mindful trading strategies incorporate principles of mindfulness into the decision-making process and overall approach to trading. These strategies aim to enhance trader awareness, emotional regulation, and decision-making ability, thereby promoting a more disciplined and effective trading experience. Here are several mindful trading strategies that traders can consider:

- Meditative Practices Before Trading: Before starting the trading day, practitioners of mindful trading often engage in meditative practices such as deep breathing, visualization, or mindfulness meditation. This helps calm the mind, reduce stress, and enhance focus for making clear and rational trading decisions.

- Developing a Trading Plan Based on Values and Intentions: Mindful traders create a trading plan that reflects their core values, long-term goals, and intentions. This plan serves as a guidepost during volatile market conditions and helps maintain consistency in decision-making.

- Staying Present and Aware During Trading: Mindful traders practice staying present and aware of their thoughts, emotions, and reactions while actively trading. They observe market movements without getting caught up in speculative thoughts or impulsive actions.

- Setting Mindful Stop-Loss and Take-Profit Levels: Instead of solely relying on technical indicators or market trends, mindful traders set stop-loss and take-profit levels based on a balanced assessment of risk and reward. They adjust these levels mindfully as market conditions evolve.

- Practicing Patience and Non-Attachment: Mindful trading involves cultivating patience and non-attachment to outcomes. Traders understand that market fluctuations are inevitable and focus on maintaining a steady, disciplined approach rather than chasing short-term gains.

- Regular Self-Reflection and Journaling: Mindful traders engage in regular self-reflection and journaling to assess their trading decisions, emotions, and overall performance. This practice helps identify patterns, strengths, and areas for improvement in a non-judgmental manner.

- Utilizing Mindfulness Techniques During Stressful Situations: During times of market stress or uncertainty, mindful traders employ mindfulness techniques such as breathing exercises or brief pauses to regain composure and clarity before making critical trading decisions.

- Integrating Risk Management with Mindfulness: Mindful traders prioritize effective risk management strategies, such as position sizing and diversification, while maintaining mindfulness of their risk tolerance and overall portfolio objectives.

- Continuous Learning and Adaptation: Mindful trading is a journey of continuous learning and adaptation. Traders remain open to new strategies, market insights, and feedback, adjusting their approach mindfully based on evolving market conditions and personal growth.

- Seeking Support and Community: Mindful traders recognize the importance of support networks and communities. They actively seek mentorship, share insights with peers, and contribute to a positive trading environment that promotes mindfulness and mutual learning.

By integrating these mindful trading strategies into their daily routines, traders can cultivate a more disciplined, focused, and resilient approach to navigating the complexities of financial markets while fostering personal growth and sustainable success over time.

Tools and Resources for Mindful Traders

Tools and resources play a crucial role in supporting mindful traders by facilitating mindfulness practices, enhancing decision-making capabilities, and promoting overall well-being in the trading environment. Here are several categories of tools and resources that mindful traders can utilize:

- Meditation and Mindfulness Apps:

- Headspace: Offers guided meditation sessions tailored for stress reduction and focus enhancement.

- Calm: Provides meditation sessions, breathing exercises, and sleep stories to promote relaxation and mindfulness.

- Insight Timer: Features a variety of guided meditations, music tracks, and community support for mindfulness practice.

- Trading Platforms with Built-in Analytics:

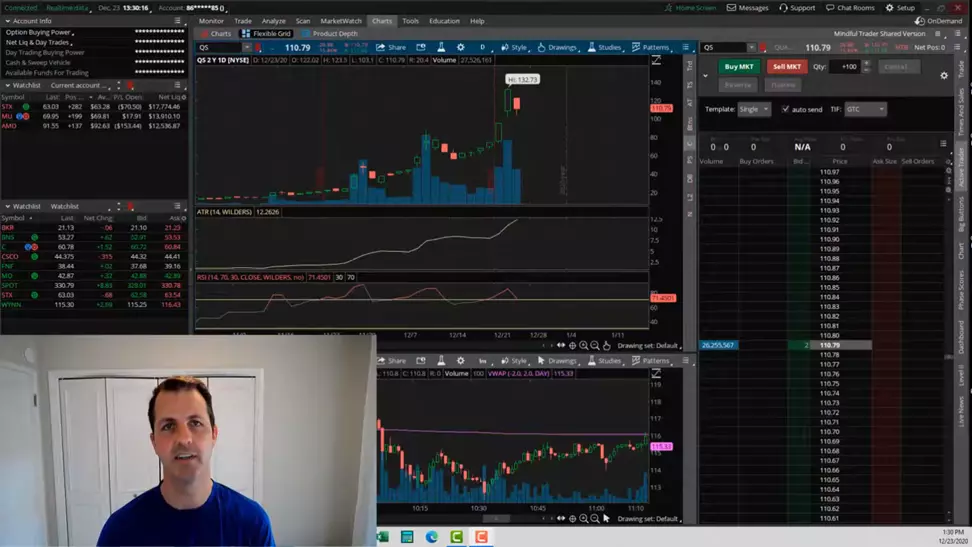

- Thinkorswim: Offers advanced charting tools, technical analysis, and real-time data for informed decision-making.

- MetaTrader 4 (MT4): Known for its comprehensive charting capabilities and algorithmic trading features.

- TradingView: Provides customizable charts, technical analysis tools, and social trading features for collaborative insights.

- Risk Management Tools:

- Position Size Calculator: Helps determine optimal position sizes based on risk tolerance and account balance.

- Volatility Indicators: Tools that assess market volatility and adjust trading strategies accordingly.

- Stop-Loss and Take-Profit Orders: Available on most trading platforms to automate risk management based on predefined levels.

- Educational Resources and Courses:

- Books on Mindful Trading: Such as “The Mindful Trader” by Gary Dayton, focusing on integrating mindfulness with trading strategies.

- Online Courses: Offered by platforms like Udemy or Coursera, covering topics from basic trading principles to advanced mindfulness techniques.

- Webinars and Workshops: Conducted by experienced traders or mindfulness practitioners, providing practical insights and interactive learning opportunities.

- Community and Support Networks:

- Trading Forums: Platforms like Trade2Win or Elite Trader where traders discuss strategies, share insights, and offer support.

- Social Media Groups: Facebook Groups, LinkedIn communities, or Twitter chats focused on mindful trading and market analysis.

- Local Meetups: Organized gatherings for traders to network, exchange ideas, and participate in mindfulness exercises together.

- Journaling and Reflection Tools:

- Trading Journals: Templates or digital tools to track trades, emotions, and reflections on decision-making processes.

- Mindfulness Diaries: Prompts and guided exercises for self-reflection on mindfulness practices and their impact on trading performance.

- Physical Well-being Resources:

- Ergonomic Trading Setup: Adjustable desks, ergonomic chairs, and proper lighting to support physical comfort during trading sessions.

- Fitness and Wellness Apps: Exercise routines, nutrition trackers, and mindfulness exercises to promote overall well-being and mental clarity.

- Psychological Support Services:

- Trading Psychologists: Professionals specializing in mental performance coaching for traders, addressing stress management and emotional resilience.

- Online Counseling: Accessible through platforms like BetterHelp or Talkspace, offering confidential support for mental health and trading-related stressors.

By integrating these tools and resources into their trading routines, mindful traders can enhance their focus, decision-making skills, and emotional resilience, fostering a sustainable and successful trading practice grounded in mindfulness principles.

Mindful Trader vs. Traditional Trading

Comparing Mindful Trading with Traditional Trading highlights fundamental differences in approach, mindset, and outcomes. Here’s a structured comparison between the two:

- Mindset and Approach:

- Mindful Trading: Emphasizes awareness of present-moment experiences, including thoughts, emotions, and external factors. Traders practice non-judgmental observation and strive for emotional balance and clarity.

- Traditional Trading: Often focuses on technical analysis, market trends, and financial indicators. Traders may prioritize profit maximization and react to market fluctuations based on historical data and trends.

- Decision-Making Process:

- Mindful Trading: Decisions are made with a deliberate, conscious approach. Traders assess risk and reward while considering the impact on their emotional state and long-term goals.

- Traditional Trading: Decision-making can be influenced by short-term market movements, news events, and algorithmic triggers. Traders may react impulsively to rapid changes in market conditions.

- Emotional Regulation:

- Mindful Trading: Focuses on managing emotions such as fear, greed, and impatience through mindfulness practices like meditation and breathing exercises. Traders aim to maintain composure and make rational decisions.

- Traditional Trading: Emotional responses can impact trading decisions significantly. Traders may experience stress, anxiety, or euphoria based on market outcomes, affecting judgment and risk management.

- Risk Management:

- Mindful Trading: Integrates risk management strategies with mindfulness principles. Traders set clear stop-loss levels, assess risk tolerance mindfully, and adapt strategies based on changing market conditions.

- Traditional Trading: Relies on technical analysis, stop-loss orders, and diversification strategies to manage risk. Risk assessment may focus more on quantitative factors rather than emotional and psychological considerations.

- Long-Term vs. Short-Term Focus:

- Mindful Trading: Often adopts a long-term perspective, prioritizing consistency and sustainability over immediate gains. Traders aim for gradual growth and personal development.

- Traditional Trading: Can involve both short-term and long-term strategies. Traders may engage in day trading for quick profits or hold positions for extended periods based on market forecasts and trends.

- Personal Growth and Well-being:

- Mindful Trading: Supports personal growth through self-reflection, mindfulness practices, and continuous learning. Traders prioritize mental well-being and emotional resilience alongside financial success.

- Traditional Trading: Focuses primarily on financial outcomes and market performance. Personal development and psychological aspects may be secondary to achieving profitability.

- Adaptability and Flexibility:

- Mindful Trading: Encourages adaptability and flexibility in response to changing market dynamics and personal circumstances. Traders adjust strategies mindfully while maintaining a balanced approach.

- Traditional Trading: Often relies on predefined strategies and market analysis techniques. Traders may face challenges in adapting quickly to unexpected events or shifts in market sentiment.

In summary, while traditional trading methods center on technical analysis, market trends, and financial outcomes, mindful trading integrates mindfulness practices to enhance awareness, emotional regulation, and decision-making processes. Mindful traders strive for a balanced approach that considers both financial goals and personal well-being, aiming for sustainable success in the dynamic world of financial markets.

Steps to Become a Mindful Trader

Becoming a mindful trader involves cultivating awareness, developing emotional resilience, and integrating mindfulness practices into your trading routine. Here are steps to help you become a mindful trader:

- Understand Mindfulness and Its Benefits:

- Learn about mindfulness and its application in trading. Understand how mindfulness can enhance focus, decision-making, and emotional regulation.

- Start a Mindfulness Practice:

- Begin with basic mindfulness exercises such as deep breathing, body scan meditation, or mindful walking. Dedicate time each day to practice mindfulness to develop awareness and concentration.

- Observe Your Thoughts and Emotions:

- During trading and throughout the day, observe your thoughts and emotions without judgment. Notice how certain thoughts or emotions influence your trading decisions.

- Create a Trading Plan with Intentions:

- Develop a trading plan that aligns with your values and long-term goals. Set clear intentions for each trade, focusing not only on profit potential but also on risk management and emotional well-being.

- Practice Patience and Discipline:

- Cultivate patience in waiting for the right trading opportunities. Avoid impulsive decisions driven by fear or greed. Stick to your trading plan and strategy consistently.

- Implement Mindful Decision-Making:

- Before making a trade, take a moment to pause and check in with yourself. Use mindfulness techniques like deep breathing to calm your mind and assess the situation objectively.

- Manage Stress and Emotions Effectively:

- Develop strategies to manage stress during volatile market conditions. Practice mindfulness techniques such as progressive muscle relaxation or mindfulness-based stress reduction (MBSR) to stay grounded.

- Keep a Trading Journal:

- Maintain a trading journal to track your trades, emotions, and reflections. Review your journal regularly to identify patterns in your trading behavior and areas for improvement.

- Seek Continuous Learning and Feedback:

- Stay informed about market trends, trading strategies, and mindfulness practices. Engage in continuous learning through books, courses, webinars, and discussions with experienced traders.

- Build a Support Network:

- Connect with other mindful traders or join communities where you can share experiences, insights, and challenges. Seek mentorship from traders who practice mindfulness in their trading approach.

- Practice Gratitude and Self-Compassion:

- Cultivate gratitude for both successes and setbacks in your trading journey. Practice self-compassion by treating yourself kindly and learning from mistakes without self-judgment.

- Adapt and Evolve Your Approach:

- Remain flexible and adaptable in response to changing market conditions and personal growth. Adjust your trading strategies mindfully while staying true to your overall trading plan and goals.

By following these steps and integrating mindfulness into your trading routine, you can develop the mindset and habits of a mindful trader. Over time, mindfulness will become a natural part of your trading practice, leading to improved decision-making, emotional resilience, and overall trading performance.

Common Challenges in Mindful Trading

Mindful trading, while beneficial, comes with its own set of challenges that traders often encounter. These challenges can affect one’s ability to maintain mindfulness and impact trading performance. Here are some common challenges in mindful trading:

- Emotional Reactivity: Traders may struggle with emotional reactions to market fluctuations, such as fear of losses or excitement from gains. These emotions can cloud judgment and lead to impulsive trading decisions.

- Maintaining Focus: Staying present and focused during trading sessions can be challenging, especially with distractions from market noise, news updates, or personal stressors.

- Patience in Waiting for Opportunities: Mindful trading emphasizes waiting for optimal trading opportunities based on a well-defined strategy. Traders may find it difficult to maintain patience during periods of market inactivity or uncertainty.

- Balancing Risk and Reward: Assessing and managing risk mindfully requires discipline and clarity. Traders may struggle with setting appropriate stop-loss levels or adjusting positions based on changing market conditions.

- Overcoming Biases: Cognitive biases, such as confirmation bias or anchoring bias, can influence decision-making processes. Mindful traders need to recognize and mitigate these biases to make objective trading decisions.

- Dealing with Uncertainty: Financial markets are inherently unpredictable, and uncertainty can trigger stress or anxiety. Mindful traders must learn to accept and navigate uncertainty while maintaining emotional stability.

- Consistency in Practice: Establishing a consistent mindfulness practice alongside trading routines can be challenging. Traders may struggle with integrating mindfulness techniques into their daily trading activities.

- Self-Discipline: Following a trading plan and adhering to predefined rules require self-discipline. Mindful traders need to resist impulses to deviate from their plan based on emotional reactions or external influences.

- Handling Losses: Losses are inevitable in trading, and dealing with them mindfully involves accepting losses as part of the learning process. Traders may find it challenging to maintain resilience and bounce back after significant losses.

- Integrating Mindfulness with Technical Analysis: Balancing the principles of mindfulness with technical analysis and market fundamentals can be complex. Traders need to find a harmonious integration that supports their overall trading strategy.

- Time Management: Allocating time for mindfulness practices, trading analysis, and personal well-being can be demanding. Mindful traders may need to prioritize effectively to maintain a balanced approach.

Addressing these challenges requires commitment, self-awareness, and ongoing practice. Mindful traders benefit from cultivating resilience, developing strategies to manage emotions, and continuously refining their approach to achieve long-term success in the dynamic world of financial markets.

Mindful Trader Reviews and Testimonials

Reviews and testimonials from mindful traders provide valuable insights into the benefits, challenges, and overall impact of integrating mindfulness into trading practices. These testimonials often highlight personal experiences, successes, and lessons learned from adopting a mindful approach to trading. Here’s how mindful trader reviews and testimonials can be structured:

Structure of Mindful Trader Reviews and Testimonials:

- Introduction:

- Briefly introduce the trader providing the review/testimonial.

- Mention their trading experience and background.

- Initial Challenges:

- Describe the challenges or issues the trader faced before adopting mindful trading practices.

- Highlight common issues such as emotional reactions, impulsiveness, or stress.

- Discovery of Mindful Trading:

- Explain how the trader discovered mindfulness and its potential benefits for trading.

- Discuss what motivated them to explore mindfulness techniques in trading.

- Benefits Experienced:

- Detail the positive changes and benefits observed after integrating mindfulness into their trading routine.

- Include improvements in decision-making, emotional regulation, and overall trading performance.

- Specific Mindfulness Techniques Used:

- Specify the mindfulness techniques or practices that were most effective for the trader.

- Examples include meditation, breathing exercises, mindfulness-based stress reduction (MBSR), etc.

- Impact on Trading Decisions:

- Provide examples of how mindfulness influenced specific trading decisions.

- Discuss instances where mindfulness helped avoid impulsive actions or manage risk effectively.

- Personal Growth and Development:

- Share insights into how mindful trading contributed to personal growth and development.

- Discuss improvements in patience, discipline, and resilience in the face of market challenges.

- Long-Term Results:

- Summarize the long-term impact of practicing mindful trading.

- Include reflections on sustained benefits and continuous improvement over time.

- Conclusion:

- Conclude with a summary of the trader’s overall experience with mindful trading.

- Optionally, provide advice or encouragement for other traders considering mindfulness techniques.

Example Mindful Trader Review/Testimonial:

Name: John Doe

Background: Experienced trader with 10+ years in financial markets

Introduction:

“Before discovering mindful trading, I struggled with emotional reactions and impulsive decisions that often led to inconsistent results in my trading.”

Discovery of Mindful Trading:

“I stumbled upon the concept of mindful trading through a recommendation from a fellow trader. Intrigued by the potential benefits of integrating mindfulness into my routine, I decided to explore further.”

Benefits Experienced:

“Mindful trading has transformed my approach completely. I now approach each trading session with a calm and focused mindset. This has significantly improved my decision-making process and helped me manage risk more effectively.”

Specific Techniques Used:

“I started with daily meditation sessions before trading, which helped me maintain clarity and composure during volatile market conditions. I also practiced mindful breathing techniques to stay grounded.”

Impact on Trading Decisions:

“Mindfulness has enabled me to avoid impulsive trades based on emotions. I now take a step back to assess the situation mindfully before making any decisions, which has minimized losses and maximized profitable trades.”

Personal Growth and Development:

“Beyond trading, mindfulness has positively impacted my personal life. I’ve become more patient, disciplined, and resilient, which has translated into improved overall well-being.”

Long-Term Results:

“Over time, mindful trading has become second nature to me. I continue to see consistent improvements in my trading performance and look forward to further growth.”

Conclusion:

“I would highly recommend mindful trading to anyone serious about improving their trading skills and emotional resilience. It’s not just about making better trades; it’s about fostering a healthier approach to both trading and life.”

By structuring reviews and testimonials in this manner, readers can gain a deeper understanding of how mindfulness practices have influenced real traders’ experiences and outcomes in the financial markets. Such insights can inspire and encourage others to explore mindful trading techniques for themselves.

Mindful Trading in Different Markets

Mindful trading principles can be applied across various financial markets, each with its unique dynamics and challenges. Here’s a look at how mindful trading can be adapted to different markets:

1. Stock Market

Approach: Mindful trading in the stock market involves:

- Awareness: Being mindful of market trends, company fundamentals, and investor sentiment.

- Emotional Regulation: Managing emotions like fear and greed to make rational decisions.

- Long-Term Perspective: Focusing on sustainable growth and value investing rather than short-term fluctuations.

Techniques: Using mindfulness techniques such as meditation to enhance focus during stock analysis and decision-making.

2. Forex Market

Approach: Mindful trading in the forex market includes:

- Patience and Discipline: Waiting for favorable currency pairs and market conditions.

- Risk Management: Setting mindful stop-loss and take-profit levels based on market analysis.

- Adaptability: Being open to sudden changes in geopolitical events and economic data.

Techniques: Practicing mindfulness to reduce stress during high volatility trading sessions and staying composed during currency fluctuations.

3. Cryptocurrency Market

Approach: Mindful trading in cryptocurrencies involves:

- Risk Awareness: Understanding the high volatility and speculative nature of digital assets.

- Security Awareness: Being mindful of security risks associated with cryptocurrency exchanges and wallets.

- Market Sentiment: Balancing technical analysis with awareness of market sentiment and social media influence.

Techniques: Using mindfulness practices to stay focused amid rapid price changes and avoiding impulsive trading decisions.

4. Commodities Market

Approach: Mindful trading in commodities focuses on:

- Supply and Demand: Being aware of global supply chain disruptions and geopolitical factors affecting commodity prices.

- Technical Analysis: Using mindful technical analysis to predict price movements based on historical data and market trends.

- Diversification: Practicing mindfulness in diversifying commodity portfolios to manage risk effectively.

Techniques: Incorporating mindfulness exercises to maintain clarity and decision-making during commodity market fluctuations.

5. Futures Market

Approach: Mindful trading in futures involves:

- Contract Specifics: Understanding the terms and conditions of futures contracts and their expiration dates.

- Leverage Management: Being mindful of the leverage used in futures trading and its impact on risk and reward.

- Real-Time Decision Making: Practicing mindfulness to make quick decisions based on real-time market data and economic indicators.

Techniques: Using mindfulness techniques to reduce stress during fast-paced trading sessions and staying focused on trading strategies.

Benefits Across Markets:

- Emotional Resilience: Mindful trading enhances emotional resilience, reducing stress and anxiety associated with trading.

- Improved Decision-Making: Traders can make more informed and rational decisions by staying present and focused on market movements.

- Consistency: Mindful traders are more likely to stick to their trading plans and strategies, leading to consistent performance over time.

In summary, mindful trading principles are adaptable across different financial markets, helping traders navigate challenges and capitalize on opportunities while maintaining emotional balance and strategic focus. Integrating mindfulness into trading practices can lead to improved overall trading performance and personal well-being regardless of the market traded.

Mindful Trading Practices for Daily Routine

Incorporating mindful trading practices into your daily routine can help you cultivate awareness, improve decision-making, and manage emotions effectively throughout your trading day. Here’s a structured approach to integrating mindfulness into your daily trading routine:

Morning Routine:

- Mindful Preparation:

- Begin your day with a mindfulness practice such as meditation, deep breathing exercises, or a mindful walk. This sets a calm and focused tone for the day ahead.

- Review Market News and Trends Mindfully:

- Take time to review overnight market movements, economic news, and upcoming events mindfully. Notice any initial reactions or emotions that arise and acknowledge them without judgment.

- Set Intentions for the Trading Day:

- Before starting trading activities, set clear intentions for what you aim to achieve. Focus on goals related to both trading outcomes and personal well-being.

During Trading Hours:

- Practice Mindful Trading Decisions:

- Before making any trade, take a moment to pause and check in with yourself. Use mindfulness techniques like deep breathing or a brief meditation to center yourself and assess the trade objectively.

- Stay Present and Aware:

- Throughout the trading day, practice staying present and aware of your thoughts, emotions, and reactions to market movements. Notice any tendencies towards impulsive decisions or emotional reactions.

- Take Mindful Breaks:

- Incorporate short mindful breaks between trading sessions or during periods of high volatility. Use these breaks to reset your focus, relax tense muscles, and regain mental clarity.

After Trading Hours:

- Reflect and Journal:

- At the end of each trading day, take time to reflect on your trading decisions and overall performance. Journal about your emotions, successful trades, challenges faced, and lessons learned.

- Review Your Trading Journal Mindfully:

- Review your trading journal mindfully to identify patterns in your trading behavior, strengths, and areas for improvement. Use this reflection to refine your trading strategies and mindset.

Throughout the Day:

- Practice Gratitude and Self-Compassion:

- Cultivate gratitude for the opportunities and experiences of the trading day, regardless of outcomes. Practice self-compassion by acknowledging mistakes without self-judgment and focusing on learning and growth.

- Stay Connected to Mindfulness Outside of Trading:

- Maintain mindfulness practices beyond trading hours. Engage in activities that promote relaxation, such as yoga, mindful eating, or spending time in nature. This helps maintain overall well-being and resilience.

Additional Tips:

- Consistency is Key: Establish a consistent routine of mindfulness practices to reinforce their benefits over time.

- Adapt to Your Needs: Customize your mindful trading routine based on your personal preferences and the specific demands of your trading style.

- Seek Support and Community: Connect with other mindful traders or join communities where you can share experiences, insights, and encouragement.

By integrating these mindful trading practices into your daily routine, you can enhance your trading performance, emotional resilience, and overall well-being. Mindfulness not only improves decision-making but also fosters a balanced approach to navigating the complexities of financial markets effectively.

Mindful Trading and Mental Health

Mindful trading can have significant positive impacts on mental health by promoting emotional regulation, reducing stress, and fostering overall well-being. Here’s how mindful trading practices can benefit mental health:

1. Emotional Regulation:

- Awareness of Emotions: Mindful trading encourages traders to observe their emotions without judgment. This awareness helps in recognizing and managing emotions such as fear, greed, or anxiety that can impact trading decisions.

- Reduced Emotional Reactivity: By practicing mindfulness, traders can develop the ability to respond to market fluctuations and losses with greater resilience and composure, rather than reacting impulsively.

2. Stress Reduction:

- Stress Management: Mindfulness techniques like meditation, deep breathing exercises, and mindful awareness can effectively reduce stress levels during trading. This is crucial in a high-pressure environment where rapid decisions are often required.

- Calm Under Pressure: Mindful traders are better equipped to handle stressful situations in the market without becoming overwhelmed, which can lead to more rational decision-making and fewer trading errors.

3. Improved Focus and Concentration:

- Enhanced Cognitive Functioning: Regular mindfulness practice enhances concentration and mental clarity, allowing traders to stay focused on their trading strategies amidst distractions and market noise.

- Better Decision-Making: With improved focus, traders can make more informed and deliberate trading decisions, considering both technical analysis and intuitive insights more effectively.

4. Psychological Well-being:

- Resilience Building: Mindful trading helps build psychological resilience by fostering acceptance of both successes and setbacks in trading. Traders learn to view challenges as opportunities for growth rather than sources of distress.

- Long-Term Perspective: Mindful traders often adopt a more balanced approach, prioritizing long-term goals and sustainable trading practices over short-term gains, which can reduce anxiety associated with market volatility.

5. Self-awareness and Personal Growth:

- Reflective Practice: Keeping a trading journal and regularly reflecting on trading experiences promotes self-awareness. Traders can identify patterns in their behavior and decision-making, leading to continuous improvement.

- Personal Development: Mindful trading encourages personal development by integrating mindfulness into daily routines beyond trading hours, such as exercise, nutrition, and relationships, which contribute to overall mental health.

6. Community and Support:

- Connection with Like-minded Traders: Engaging with a community of mindful traders provides support, validation, and shared insights. This connection reduces feelings of isolation and enhances motivation to maintain mindfulness practices.

- Professional Support: Seeking guidance from trading psychologists or mental health professionals can further enhance mental health by addressing specific challenges related to trading stress and emotional management.

Conclusion:

Incorporating mindfulness into trading practices not only enhances trading performance but also promotes mental health and well-being. By cultivating emotional regulation, reducing stress, improving focus, fostering resilience, and supporting personal growth, mindful trading empowers traders to navigate the complexities of financial markets with greater clarity, confidence, and overall mental wellness.

Future of Mindful Trading

The future of mindful trading holds promising developments as more traders recognize the profound benefits of integrating mindfulness practices into their trading routines. Here are some key aspects shaping the future of mindful trading:

1. Integration of Technology and Mindfulness:

- Mindfulness Apps and Platforms: Continued advancements in technology will likely lead to more sophisticated mindfulness apps and platforms tailored specifically for traders. These tools may offer personalized meditation sessions, real-time stress monitoring, and AI-driven insights to enhance mindfulness practices.

- Algorithmic Mindfulness: Integration of AI and machine learning algorithms to analyze trader behavior and provide feedback on emotional states. This could help traders recognize and manage emotions more effectively during trading.

2. Education and Awareness:

- Mainstream Adoption: As awareness grows about the benefits of mindful trading, educational institutions, trading academies, and financial organizations may incorporate mindfulness training into their curriculum and programs.

- Webinars and Workshops: Continued availability of webinars, workshops, and online courses focusing on mindful trading techniques. These resources will cater to both novice traders and seasoned professionals looking to enhance their trading performance through mindfulness.

3. Research and Evidence-based Practices:

- Scientific Validation: Ongoing research into the psychological and neurological effects of mindfulness on trading performance and decision-making. This research will provide empirical evidence supporting the efficacy of mindfulness in improving trading outcomes.

- Case Studies and Success Stories: More documented case studies and success stories from traders who have adopted mindful practices. These stories will inspire others to explore mindfulness as a viable strategy for achieving consistent and sustainable trading results.

4. Integration into Trading Platforms:

- Mindfulness Features: Integration of mindfulness features directly into trading platforms, such as built-in meditation timers, stress management tools, and reminders for mindful breaks. This integration will make it easier for traders to incorporate mindfulness into their daily trading routines seamlessly.

5. Holistic Approach to Trader Well-being:

- Emotional and Physical Wellness: Recognition of the importance of holistic well-being for traders, including mental, emotional, and physical health. This holistic approach will emphasize the interconnectedness of mindfulness, stress reduction, exercise, nutrition, and sleep in optimizing trading performance.

6. Community and Support Networks:

- Mindful Trading Communities: Growth of online communities and forums dedicated to mindful trading, where traders can share experiences, strategies, and support each other in maintaining mindfulness practices.

Conclusion:

The future of mindful trading is bright, driven by advancements in technology, increased awareness and education, empirical research validating its benefits, and integration into trading platforms. As mindful trading continues to evolve, it will empower traders to cultivate emotional resilience, enhance decision-making capabilities, and achieve sustainable success in navigating the complexities of financial markets with mindfulness at the core.

Pros of Mindful Trading:

- Emotional Regulation: Mindful trading helps traders develop awareness of their emotions and how they influence trading decisions. This can lead to better emotional regulation, reducing the impact of fear, greed, and impulsiveness.

- Improved Decision-Making: Practicing mindfulness enhances focus and clarity, allowing traders to make more rational and objective decisions. This can lead to better risk management and more consistent trading outcomes.

- Stress Reduction: Mindfulness techniques such as meditation and deep breathing help traders manage stress effectively during volatile market conditions. This promotes overall mental well-being and resilience.

- Long-Term Perspective: Mindful traders often adopt a more patient and disciplined approach, focusing on long-term goals rather than short-term gains. This can result in more sustainable trading practices and reduced burnout.

- Personal Growth: Mindful trading encourages self-reflection and continuous improvement. Traders learn from their experiences, develop resilience, and cultivate positive habits that extend beyond trading.

- Balanced Lifestyle: Integrating mindfulness into trading promotes a balanced lifestyle, incorporating physical health, mental well-being, and relationships. This holistic approach supports overall happiness and fulfillment.

Cons of Mindful Trading:

- Time and Commitment: Developing mindfulness requires regular practice and dedication, which may require additional time outside of trading hours. Some traders may find it challenging to maintain consistency.

- Initial Learning Curve: Traders new to mindfulness may experience a learning curve in understanding and applying mindfulness techniques effectively to trading. It may take time to see tangible improvements in trading performance.

- Integration with Trading Strategies: Balancing mindfulness with technical analysis and trading strategies can be complex. Traders may need to adapt their approach to integrate mindfulness seamlessly without compromising their trading style.

- Overconfidence: While mindfulness can enhance decision-making, there’s a risk of becoming overconfident in one’s ability to control emotions and predict market movements. Traders must remain vigilant and adaptable to changing market conditions.

- Resistance to Change: Some traders may be skeptical about the benefits of mindfulness or reluctant to incorporate new practices into their trading routines. Openness to change and willingness to experiment are essential for successful adoption.

- Market Volatility: Despite mindfulness practices, financial markets remain inherently unpredictable. Traders must manage expectations and accept that losses are part of trading, even with a mindful approach.

Conclusion:

Mindful trading offers substantial benefits in promoting emotional resilience, improving decision-making, and fostering personal growth. However, it requires dedication, patience, and an openness to change. By carefully weighing the pros and cons and integrating mindfulness into their trading routines thoughtfully, traders can enhance their overall trading performance and well-being in the dynamic world of financial markets.

Conclusion

In conclusion, mindful trading represents a transformative approach that goes beyond mere financial gains to encompass holistic well-being and sustainable success in the financial markets. By integrating mindfulness practices into their trading routines, traders can cultivate essential skills such as emotional regulation, enhanced focus, and resilience in the face of market volatility.

The future of mindful trading is promising, driven by advancements in technology that facilitate easier integration of mindfulness into trading platforms and tools. Moreover, increasing awareness and education about the benefits of mindfulness in trading are likely to lead to mainstream adoption among traders of all levels.

As we move forward, it’s essential to recognize that mindful trading is not just a trend but a fundamental shift towards a more balanced and mindful approach to financial markets. This approach emphasizes the importance of mental well-being, self-awareness, and continuous personal growth alongside financial success.

Ultimately, embracing mindful trading practices empowers traders to make more informed decisions, manage stress effectively, and maintain consistency in achieving their trading goals. By fostering a mindful mindset, traders can navigate the complexities of trading with clarity, confidence, and resilience, paving the way for a fulfilling and sustainable trading journey.